Business Accounts and

Global Payments

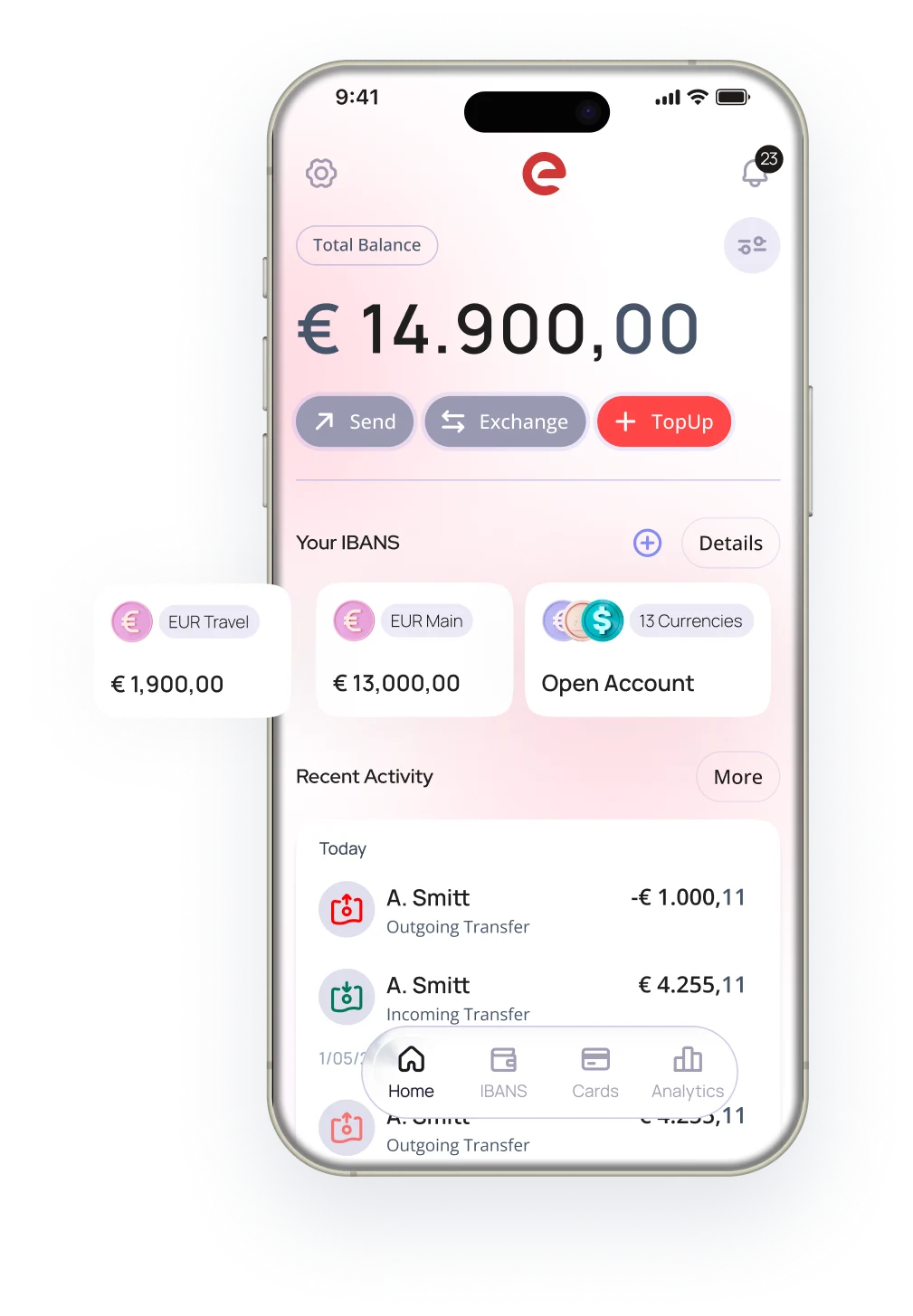

Manage multi-currency IBANs, SEPA Instant transfers, SWIFT payments, and global collections from one account and one interface.

Evonti provides IBANs, global payouts, FX, and cards in a single platform. Built for finance teams that are done with legacy payment workflows.

The Future is here!

Don’t miss our launch in 2026

Cross-border

payments,FX and

reconciliation

Cross-border payments, FX, and cards are fragmented across tools. Axon Pay centralizes everything into a unified financial operations platform, with hands-on support and a streamlined interface.

Manage multi-currency IBANs, SEPA Instant transfers, SWIFT payments, and global collections from one account and one interface.

Multi-currency IBANs for your company & entities

Competitive FX with transparent fees

SEPA Instant, SEPA, and SWIFT transfers

Batch payments for payroll, vendors & recurring payables

Create virtual and physical cards, set controls, and manage global spend across teams and currencies in real time.

Multi-currency with smart FX

Create virtual and physical cards

Real-time tracking and card management

Team limits, approvals, and spend controls

Work in a clean, intuitive interface. Invite teammates, assign roles, and manage approvals, expenses, and workflows with ease.

Granular roles and permissions for every teammate

Manage invoices, receipts, and expenses

Transaction approvals for payments, cards, and spend

Streamlined, intuitive interface for daily finance

Mid-market companies face the same complexity as large enterprises, but without the tools they have access to. Our roadmap is shaped by years of dealing with these challenges and is focused on simplifying operations, integrations, and controls.

Evonti is a technology-enabled payments platform that helps businesses initiate and manage cross-border payments and foreign exchange through a single API and operational layer. We focus on orchestration, integrations, and reporting — not on acting as a bank.

No. Evonti is not a bank, does not accept deposits, and is not part of any deposit insurance scheme. Where regulated services are required, payment functionality is delivered through appropriately licensed partner institutions.

You can integrate to initiate funds transfers, manage payees/beneficiaries, receive real-time status updates (webhooks), and access unified transaction data for tracking and reconciliation. FX execution for cross-border payments can be supported via partner-led rails (where available).

Evonti does not itself issue accounts, IBANs, or payment cards. If these services are offered, they are enabled via regulated third-party institutions and partners, and only once the required safeguarding and control arrangements are in place.

Evonti is built for companies that need reliable cross-border payment workflows — such as marketplaces, exporters/importers, payment intermediaries, and finance teams — and want a compliant, partner-led setup with modern API connectivity and reporting.

Evonti is launching soon to bring unified treasury, payments, and financial operations to agile finance teams.